más noticias

Rosas rojas sobre el Bidasoa: Memoria y justicia

Desde las Juventudes Socialistas de Euskadi, hemos vuelto a las orillas del río Bidasoa para celebrar un acto tan necesario como emotivo. Junto a Coral Fouz, hermana de Humberto, y su sobrina, quienes entre lágrimas agradecieron este gesto, y acompañados por...

JSE-EGAZ celebra en Zarautz las Jornadas de Formación «Carmen de Burgos» sobre Feminismo

Este 17, 18 y 19 de julio, las Juventudes Socialistas de Euskadi, en colaboración con la Fundación Mario Onaindia, hemos celebrado en Zarautz las Jornadas de Formación "Carmen de Burgos", unas escuelas de verano centradas en la formación feminista y el análisis...

La nueva Agrupación de Juventudes Socialistas de Margen Derecha – Txorierri arranca su andadura con un emotivo acto en Leioa

El pasado domingo 15 de junio tuvo lugar la inauguración oficial de la Agrupación de Juventudes Socialistas de Margen Derecha – Txorierri, en un acto celebrado en la Casa del Pueblo de Leioa que congregó a militantes, representantes institucionales y simpatizantes de...

Las Juventudes Socialistas de Euskadi reivindican en Bilbao una Europa de igualdad, libertad y derechos

Las Juventudes Socialistas de Euskadi organizaron y participaron el pasado 9 de mayo en la jornada “Geopolítica europea en un mundo hostil”, con motivo del Día de Europa. El acto, celebrado en Bilbao, reunió a destacadas figuras socialistas como la eurodiputada Idoia...

JSE-Egaz estrena la ‘Enekoneta’ con la que difundir que «los socialistas somos la única alternativa a más nacionalismo»

El Secretario General del PSE-EE y candidato a Lehendakari, Eneko Andueza, ha participado junto a las Juventudes Socialistas de Euskadi (JSE-Egaz) en la presentación en Bilbao de la “Enekoneta”, la furgoneta con la que Juventudes Socialistas participará en la campaña...

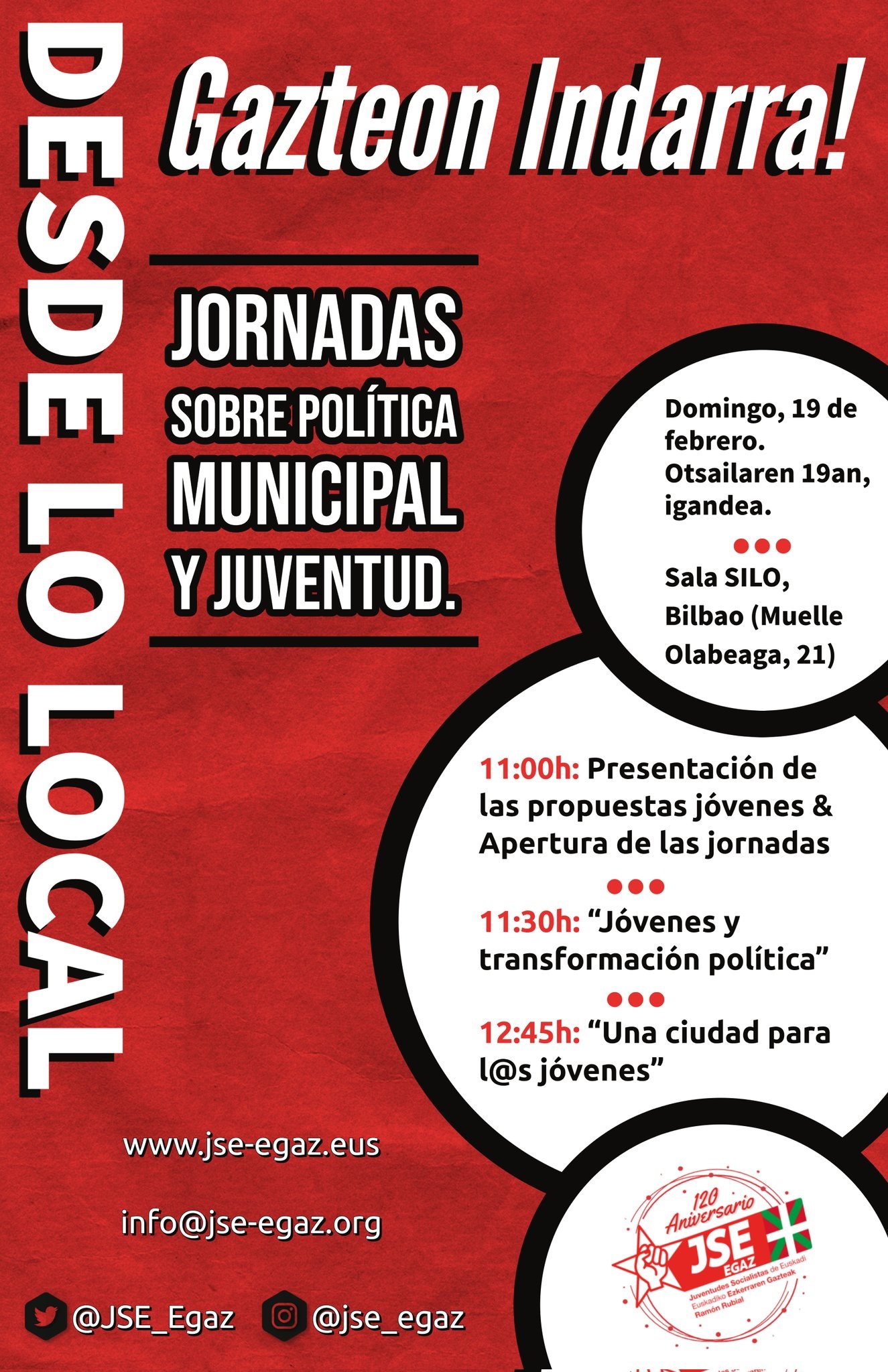

Juventudes Socialistas celebra en Bilbao su 120 aniversario con un Congreso Nacional y una exposición histórica

La organización celebrará en Bilbao, los días 30 de septiembre y 1 de octubre, su XI Congreso Nacional Ordinario para renovar su proyecto político y su dirección orgánica en Euskadi, que liderará Gabriel Arrúe, y desarrollará una exposición sobre su historia en el...

Homenaje a la II República en el Columbario de Orduña

Las Juventudes Socialistas de Euskadi llevaron a cabo el pasado 13 de abril en el Columbario de la Dignidad de Orduña un acto de homenaje a todas aquellas personas que dieron su vida por defender la II República. El acto, llevado a cabo la víspera del 14 de abril, día...